Answer:

The value of the firm's common stock is $48

Step-by-step explanation:

The constant dividend growth model is used to determine the market value of the share and which can be expressed as:

here;

the value of the current market price of the share (P) = unknown?

The dividend expected in the next year (D) = $2.40

The required rate of return (r) = 12% = 0.12

The growth rate (g) = 7& = 0.07

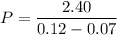

Replacing the values into the above equation:

P = $48