Given:

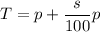

The formula for total cost is

where, p is the price of item and s is the sales tax rate (as a percent).

You pay $14.77 for an item priced at $14.

To find:

The the tax rate.

Solution:

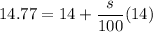

You pay $14.77 for an item priced at $14. So,

Total cost (T) = $14.77

Price of item (p) = $14

Putting T=14.77 and p=14 in given formula, we get

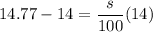

Multiply both sides by 100.

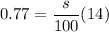

Divide both sides by 14.

Therefore, the tax rate is 5.5%.