Answer:

The Internal Rate of Return is the discount rate that discounts a series of cashflows such that the Net Present Value becomes zero.

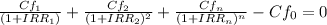

It is calculated in the same way the NPV is calculated which is to subtract the discounted cash outflows from the discounted cash inflows but this time it will be the subject of the equation which will be equated to zero.

Formula therefore is;

Excel worksheets, financial calculators and solving the equation can all be used to find IRR.

The higher the IRR, the better for a project because it means that the project has high cash inflows that would take a higher rate to discount to zero.

The decision rule is the pick a project that has a higher IRR than the firm's Required rate of return because it means that the NPV will be more than zero.