Answer:

Its better to invest at 2.45% interest rate compounded daily.Step-by-step explanation:

We are given

Principal Amount = $350,000

Time t = 3 years

We need to determine which investment will yield greater return

a) 2.5% compounded monthly

b) 2.45% compounded daily

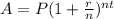

The formula used will be:

a) 2.5% compounded monthly

We have P=$350,000 t= 3 years, r = 2.5 or 0.025 and n= 12

Putting values and finding A

So, the return of investment in 3 years would be $377650 if interest rate is 2.5% compounded monthly.

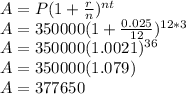

a) 2.45% compounded daily

We have P=$350,000 t= 3 years, r = 2.5 or 0.025 and n= 365

Putting values and finding A

So, the return of investment in 3 years would be $728735 if interest rate is 2.45% compounded daily.

So, if we invest 2.45% interest rate that is compounded daily we will make $728735 while if we invest 2.5% interest rate that is compounded monthly we will make $377650

So, its better to invest at 2.45% interest rate compounded daily.