Answer:

3.44%

Step-by-step explanation:

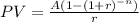

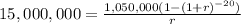

The interest rate that makes her indifferent is the rate that equates the present value (PV) of the annuity to $15,000,000, the amount receivable in the first choice.

Where A = equal annual payment = $1,050,000

n = 20 years

Using a financial calculator or interpolation, the value of r that solves the equation is 3.443209% or approximately 3.44%.