T-1:

Table-1 vide annex

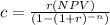

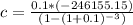

Applying EAC formula

c = \frac{r(NPV)}{(1-(1+r)^{-n} )}

c: equivalent annuity cash flow

NPV: Net present value

r: rate per period

n: number of periods

we have

c = $ - 98 982,63

T-2

Table-2 vide annex

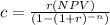

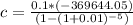

Applying EAC formula

c = \frac{r(NPV)}{(1-(1+r)^{-n} )}

c: equivalent annuity cash flow

NPV: Net present value

r: rate per period

n: number of periods

we have

c = - $ 97 511.17