Answer:

The monthly withdrawals are $3,537.85 and will last for 23 years.

Step-by-step explanation:

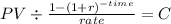

We have to calculate the monthly installment of an annuity:

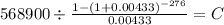

PV 568,900.00

time 276 (23 years x 12 months)

rate 0.004333333 (5.2% = 5.2 / 100 = 0.052 per year we now divide by the 12 months of a year and get the rate for monthly withdrawals.

C $ 3,537.85