Answer:

The answer is below

Explanation:

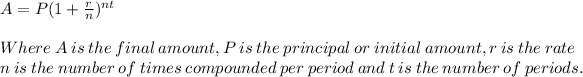

The compound interest is given by the formula:

For the same amount of principal (P) for both plan A and B:

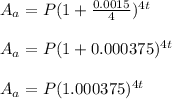

Plan A offers a quarterly compounded interest rate of 0.15%. That is r = 0.15% = 0.0015, n = 4. Therefore:

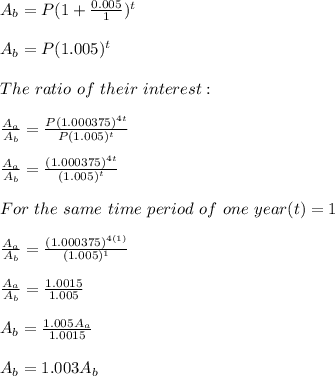

Plan B offers annual compounded interest rate of 0.5%. That is r = 0.5% = 0.005, n = 1. Therefore:

Plan B is the better plan, it is greater by a factor of 1.003