Answer: $18.88

Step-by-step explanation:

The dividends are being paid quaterly so in other to use those dividends, the cost of capital will have to be converted to a quaterly rate as well.

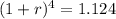

r =

![\sqrt[4]{1.124} - 1](https://img.qammunity.org/2021/formulas/business/college/l44kac22rz3jycp5zrj51zpp2hrqv4gnca.png)

r = 2.966%

Using the Dividend discount model, the price per share is;

= Next Dividend / ( cost of capital - growth rate)

= 0.56 / 0.02966

= $18.88

Note; there is no growth rate as the company will pay that dividend forever.