Answer: 34.13%.

Step-by-step explanation:

Given : Expected return :

Standard deviation:

Let x be the stock returns.

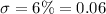

Then, the probability that stock returns between 12% and 18%:

![P(0.12<x<0.18)=P((0.12-0.12)/(0.06)<(x-\mu)/(\sigma)<(0.18-0.12)/(0.06))\\\\=P(0<Z<1)\ \ \ [\because z=(x-\mu)/(\sigma)]\\\\=P(Z<1)-P(Z<0)\\\\=0.8413-0.5\ \ \ \text{[By z-table]}\\\\=0.3413](https://img.qammunity.org/2021/formulas/business/college/cgxo0ikpg8sl51i3n7pskzrjhcm2jvmnt9.png)

Hence, the likelihood that this stock returns between 12% and 18% is 34.13%.