Answer:

9.40%

Explanation:

Given:

Annual coupon rate = 11%

Time left to maturity = 11 years

Par value of bond = 1000

Present value of bond = 1153.60

Required: Find Yeild to Maturity (YTM)

To find the yield to maturity, use the formula below:

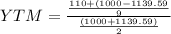

YTM = [Annual coupon+(Face value-Present value)/time to maturity]/(Face value+Present value)/2

where annual coupon = 1000 * 11% = 110

Thus,

YTM = 9.40%

Therefore the approximate YTM is 9.40%