Answer:

Project A should be accepted.

Step-by-step explanation:

The initial investment of project A = $78000

The initial investment of project B = $78000

The cash inflows of project A = $32000

The time period for project A = 3 years

The cash inflow of project B = $44400

The time period for project B = 2 years.

Interest rate (r ) = 10%

Now find the net present value of both project and then decide which one has to accept.

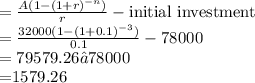

The net present value of project A:

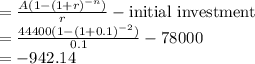

The net present value of project B:

Project A should be accepted because project B has a negative net present value.