Answer:

The answer is "24.48%"

Step-by-step explanation:

Given:

current Bond Value is PV(0.045,12,78,1000) = 1300.91

rate = 0.045

time =

coupon number = pmt = 78

price = fv=1000

Total profit = 1300.91 -1061

= 239.91.

Throughout,

The year a bondholder got we should include a coupon rate =78.

So, profit:

return:

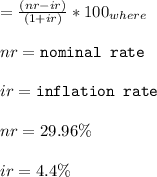

The actual return on investment accrued to both the formula of brandt is

by replacing the formula would result in a real return rate of 24.48 %