Answer:

QUESTION 2 -> Correct option: A.

QUESTION 3 -> Correct option: C.

Explanation:

QUESTION 2

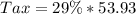

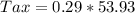

To find the amount of tax we just need to multiply the tax rate by the original price of the product:

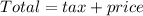

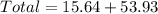

Then, to find the total selling price, we need to sum the original price to the tax value:

Correct option: A.

QUESTION 3

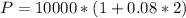

To find the final value after 2 years, we can use the formula:

Where P is the final value, Po is the inicial value, r is the interest and t is the amount of time. Then, we have that:

Correct option: C.