Answer:

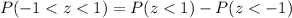

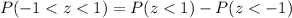

And we can find the probability with this difference

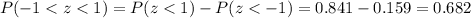

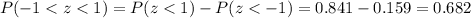

And we can use the normal standard distribution or excel and we got:

So then we expect a proportion of 0.682 between 11.5 and 13.5

Explanation:

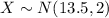

Let X the random variable that represent the price earning ratios of a population, and for this case we know the distribution for X is given by:

Where

and

and

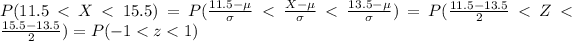

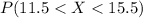

We want to find the following probability

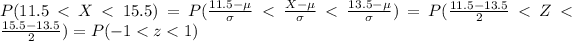

And we can use the z score formula given by:

Using this formula we got:

And we can find the probability with this difference

And we can use the normal standard distribution or excel and we got:

So then we expect a proportion of 0.682 between 11.5 and 13.5