Answer:

$3.06

Step-by-step explanation:

The put call parity shows the relationship between the price of European put options and European call options of the same strike price and expiry date.

Given that:

Strike price (K) = $50

Price (C) = $6

rate (r) = 6% = 0.06

Stock price (SO) = $51

Time (T) = 1 year

Dividend (D) = $1

The period of dividend (t) = 6 months = 0.5 years

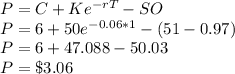

The put call parity (P) is given by the equation:

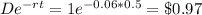

The dividend present value =