Note that

Answer:

Mary's risk premium is $0.9375

Explanation:

Mary's utility function,

Mary's initial wealth = $100

The gamble has a 50% probability of raising her wealth to $115 and a 50% probability of lowering it to $77

Expected wealth of Mary,

= (0.5 * $115) + (0.5 * $77)

= (0.5 * $115) + (0.5 * $77)

= 57.5 + 38.5

= 57.5 + 38.5

= $96

= $96

The expected value of Mary's wealth is $96

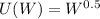

Calculate the expected utility (EU) of Mary:-

![E_u = [0.5 * U(115)] + [0.5 * U(77)]\\E_u = [0.5 * 115^(0.5)] + [0.5 * 77^(0.5)]\\E_u = 5.36 + 4.39\\E_u = \$ 9.75](https://img.qammunity.org/2021/formulas/mathematics/college/r2xyypdxutumhcx1qn9urh98w5pzng4sps.png)

The expected utility of Mary is $9.75

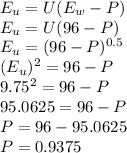

Mary will be willing to pay an amount P as risk premium to avoid taking the risk, where

U(EW - P) is equal to Mary's expected utility from the risky gamble.

U(EW - P) = EU

U(94 - P) = 9.63

Square root (94 - P) = 9.63

If Mary's risk premium is P, the expected utility will be given by the formula:

Mary's risk premium is $0.9375