Answer:

Normal:

$ 3,509.7470

$ 563.7093

$ 2,000.00

Due:

$3,930.9167

$ 597.5319

$ 2,000.00

Step-by-step explanation:

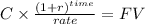

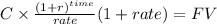

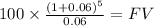

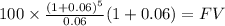

We solve using the formula for common annuity and annuity-due on each case:

(annuity-due)

(annuity-due)

First:

C 200.00

time 10

rate 0.12

Normal: $3,509.7470

Due: $3,930.9167

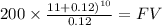

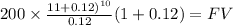

Second:

$563.7093

$597.5319

Third:

No interest so no time value of money the future value is the same as the sum of the receipts regardless of time or being paid at the beginning or ending.

1,000 + 1,000 = 2,000