Answer:

Yield price at year-end $746.55

taxable income: capital gain + coupon payment

16.55 + 60 = $76.55

Step-by-step explanation:

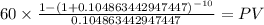

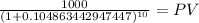

First we solve for the yield, which is the rate at which the discounted maturity and bond coupon payment matches the market price:

C 60.000

time 10

rate 0.104863443

PV $361.0956

Maturity 1,000.00

time 10.00

rate 0.104863443

PV 368.90

PV c $361.0956

PV m $368.9045

Total $730.0001

So the market rate is 10.49%

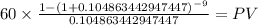

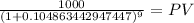

Now we solve for the value of the bond at year-end:

C 60.000

time 9

rate 0.104863443

PV $338.9613

Maturity 1,000.00

time 9.00

rate 0.104863443

PV 407.59

PV c $ 338.96

PV m $ 407.59

Total $ 746.55