Answer:

0.88 USD/CAD

Step-by-step explanation:

As per relative purchase power parity theory, the difference between the inflation rates of two currencies is equal to the rate by which one currency appreciates or depreciates with respect to the other.

In the given case, the difference between inflation rates of two currencies is 2% i.e rate of inflation in USA has been higher by 2% than the rate of inflation in Canada.

As per relative purchase power parity theory, in such a scenario, Canadian dollar would appreciate by 2% or US Dollar will depreciate by 2%.

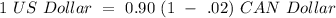

SPOT rate 1 year ago ,for 1 USD $ = 0.90 CAN$

Difference in inflation rate = Inflation rate in USA - Inflation rate in canada

= + 2%

Thus, CAN $ will appreciate by 2% over the period of 1 year while USD will depreciate by 2%. So the spot rate as on today would be,

Thus,

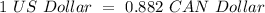

OR 0.88 CAD approx.

OR 0.88 CAD approx.