Answer:

$274.95

Explanation:

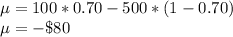

The mean return for the option is:

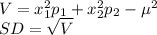

The variance and standard deviation are given by:

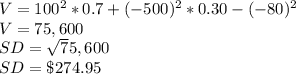

Where "x" represents the possible returns ($100 and -$500), and "p" represents their respective likelihoods (70% and 30%). The standard deviation is:

The standard deviation of the day trader's option value is $274.95.