Answer:

$20000

Step-by-step explanation:

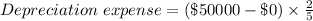

Given: Total cost of computer system= $50000.

Residual value= $5000.

Useful life= 5 years.

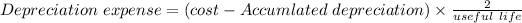

Now, calculating depreciation expense as per double-declining balance method.

⇒

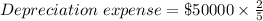

⇒

∴

Hence, $20000 is the depreciation expense for first year as per double-declining balance method.