Answer:

$320000

Step-by-step explanation:

Given: Purchase price of land= $1000000.

Kit and Amy contributed= $200000 each.

Aaron contributed= $600000.

New value of property= $1600000.

First finding the share of each partner in the property.

As we know, contribution made by Kit, Amy and Aaron are $200000, $200000, and $600000 respectively.

∴ ratio of share of each partner in property are

Hence, Kit, Amy and Aaron´s share is

.

.

Now, calculating the amount, which will be included in Kit´s gross estate.

As given, current worth of property is $1600000.

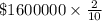

Amount will be included in Kit´s gross estate=

∴ Amount will be included in Kit´s gross estate=

Hence, Kit´s gross estate value is $320000.