Answer:

$105.60

Step-by-step explanation:

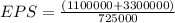

Given: Total dividend paid= $1100000.

Retained earning= $3300000.

Number of outstanding shares= 725000.

PE ratio= 17.4 times.

First finding earning per share.

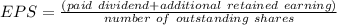

Formula;

⇒

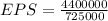

⇒

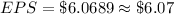

∴

Hence, earning per share (EPS)= $6.07.

Now, finding the appropriate stock price.

Price of stock=

⇒ Price of stock=

∴ Price of stock=

Hence, $105.60 would be the appropriate price of stock.