Answer:

current stock price,

= $26.84

= $26.84

Step-by-step explanation:

Given,

Most recent dividend,

= $1.50

= $1.50

Growth rate,

= 15% = 0.15 (Next 2 years)

= 15% = 0.15 (Next 2 years)

= 5% = 0.05 (remain constant after 2 years)

= 5% = 0.05 (remain constant after 2 years)

required rate of return ,

= 12% = 0.12

= 12% = 0.12

We know,

Current stock price,

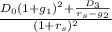

= [

= [

÷ (1 +

÷ (1 +

)] +

)] +

or,

= [{

= [{

× (1 +

× (1 +

)} ÷ (1 +

)} ÷ (1 +

)] +

)] +

or,

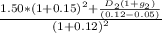

= [{$1.50 × (1 + 0.15)} ÷ (1 + 0.12)] +

= [{$1.50 × (1 + 0.15)} ÷ (1 + 0.12)] +

or,

= ($1.725 ÷ 1.12) +

= ($1.725 ÷ 1.12) +

or,

= $1.5402 + [(1.98375 + 29.75625) ÷ 1.2544]

= $1.5402 + [(1.98375 + 29.75625) ÷ 1.2544]

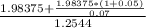

or,

= $1.5402 + (31.74 ÷ 1.2544)

= $1.5402 + (31.74 ÷ 1.2544)

or,

= $1.5402 + 25.3029

= $1.5402 + 25.3029

Therefore, current stock price,

= $26.84

= $26.84