Answer:

$0

Step-by-step explanation:

Here is the complete question: A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Ding´s capital= $60000.

Laurel´s capital= $67000.

Ezzard´s Capital= $17000

Tillman´s capital= $96000

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold for $228,000, what is the minimum amount that Ezzard's creditors would have received?

Given: Cash received= $228000

Non cash asset= $ 360000.

Profit and loss ratio= 4:2:2:2 basis.

Ezzard´s capital= $17000.

First computing for profit/loss on non cash asset of Ezzard.

We know as per ratio given is share of Ezzard is 20%

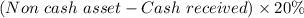

⇒ Profit/loss on non cash asset of Ezzard=

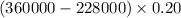

⇒ Profit/loss on non cash asset of Ezzard=

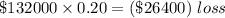

⇒ Profit/loss on non cash asset of Ezzard=

∴ Profit/loss on non cash asset of Ezzard= ($26400) loss.

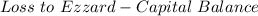

Now, finding the Deficit of Ezzard.

Ezzard´s deficit=

⇒ Ezzard´s deficit=

∴ Ezzard´s deficit=

Hence, Ezzard has $0 balance to creditor and he owe other partner $9400.