Answer:

The computations are shown below:

Step-by-step explanation:

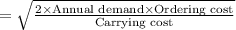

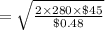

a. The computation of the economic order quantity is shown below:

= 229 units

The carrying cost is come from

= $2.40 × 20%

b. Time between placement of orders is

= Economic order quantity ÷Annual demand

= 229 ÷ 280

= 0.8179 years

So,

= 0.8179 × 365 days

= 298.53 days

We assume 365 days in a year

c. The average annual cost of ordering cost and carrying cost equals to

= Holding cost + ordering cost

= (Economic order quantity ÷ 2 × Holding cost) + (Annual demand ÷ Economic order quantity × ordering cost)

= (229 units ÷ 2 × $0.48) + (280 ÷ 229 units × $45)

= $54.96 + $55.02

= $109.98

d) Now the reorder level is

= Demand × lead time + safety stock

where, Demand equal to

= Expected demand ÷ total number of weeks in a year

= 280 pounds ÷ 52 weeks

= 5.38461

So, the reorder point would be

= 5.38461 × 3 + $0

= 16.15 pounds