Solution

1.Hotel’s cost structure Indications in percentage(%)

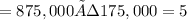

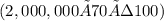

Revenue $ 2,000,000 (100)

Less: Variable expenses $ 1,300,000 65

--------------------

Contribution margin $700,000

Less: Fixed expenses $560,000 28

---------------------

Net income $140,000 7

2.Revenue declines by 30 percent

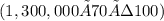

Revenue $ 1,400,000

Less: Variable expenses $910,000

---------------------

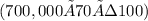

Contribution margin $490,000

Less: Fixed expenses $392,000

---------------------

Net income $98,000

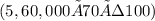

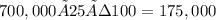

3.Operating leverage factor when revenue is $2,000,000

Operating leverage = Contribution/ Net income

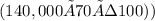

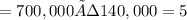

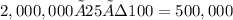

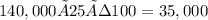

4.Operating leverage factor when increase in revenue by 25 percent

increase in revenue by 25 percent=

increase in contribution by 25 percent=

increase in net income by 25 percent =

Operating leverage = Contribution/ Net income