Solution and Explanation:

Rate of Return (ROR) Analysis:

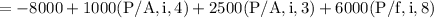

= 0

= 0

By trial and error method i= 15%

Since this is greater than MARR (12%).

The extra investment is justified, and machine B can be selected

Note: Trial and Error can be found on excel by just giving the cashflows and trying the IRR formula. it will directly give the rate of return or manually IRR can be calculated.

Thus, the option C is correct answer.

The "Incremental ROR" is less than MARR, so select machine A