Answer:

Step-by-step explanation:

Except for other fees or interests that you might owe, the payoff should be equal to the debt balance. Then, assuming no other fees or interests that you might owe, you just must calculate the balance of your debt after 112 payments (11 years, not 8).

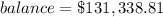

There is a very important formula to calculate the outsdanging balance of a loan, whithout calculating the complete sheet of all the monthly payments:

![balance=Loan* ([(1+r)^n-(1 + r)^m])/([(1+r)^n-1])](https://img.qammunity.org/2021/formulas/business/college/nfi2df0ftzkvgtsfy8m20b2ielvc0fygzh.png)

Where:

- balance is the outstanding balance after m months

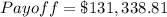

- r i s the fixed monthly rate: 10.5%/12 = 0.105/12

- n is the number of total months of the loan: 30years × 12month/year = 360 months

![balance=\$142,000* ([(1+(0.105/12))^(112)-(1 + (0.105/12))^(112)])/([(1+(0.105/12))^(360)-1])](https://img.qammunity.org/2021/formulas/business/college/tnl4j5y0spwiqgp68y4jy2tz76a7spomup.png)