Answer:

$17,123.78

Explanation:

Total taxable income is the combined income of the couple:

Tax rate applicable for a couple filling jointly is 24%.

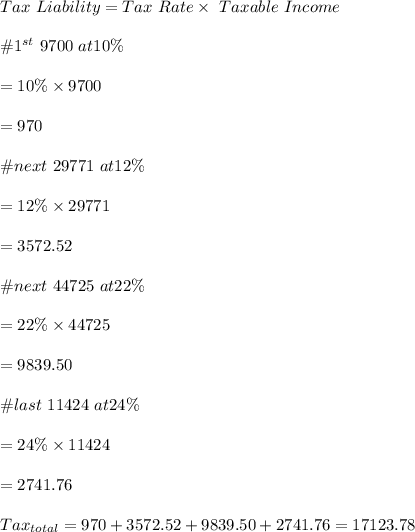

Tax liability is calculated using the applicable 2020 Tax Brackets as below:

Hence, the total tax liability for the couple's joint filing is : $17,123.78