Answer:

Taking the present time as t= 0, the scheduled loan repayments is,

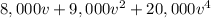

0 ---->

1 -----> $8,000

2 -----> $9,000

3 ----->

4 -----> $20,000

According to the method of equated time,Tis a dollar-weighted average of thepayment times; that is, with time measured in years,

T = ( $8,000 /$37,000)1 + ( $9,000 /$37,000)2 + ( $20,000 /$37,000)4

= ( 106,000 /37,000 ) ≈ 2.864864865 ≈ 2.86487.

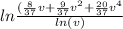

The equation of value at time t= 0 is,

=

=

wherev= (1.05)

, Solving for T gives:

, Solving for T gives:

T =

=2.82480766.