Depreciation expense = $189600

Step-by-step explanation:

Depreciation can be calculated by two methods. It can be calculated either by written down value method or it can also be calculated by straight line method. Under the straight line method, the value of depreciation remains same every year and whereas under the written down value method, the value of depreciation decreases every year but it can never be 0.

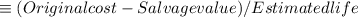

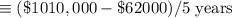

The Calculation of the depreciation expense per year using SLM as per the given data is as follows:

=$189600