Option B

The average tax rate is 20.63 %

Solution:

Given that,

Susan earned $91,000 after deductions and had a total tax due of $18,773

To find: average tax rate

From given,

Earnings = 91, 000

Tax amount = 18, 773

Let "x" be the percent of tax paid

Then, we can say,

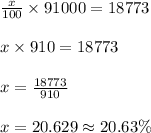

x % of 91000 = 18773

Solve the above

Thus average tax rate is 20.63 %