Answer:

The stock will be correctly priced at $54.39

Step-by-step explanation:

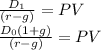

we solve for the value of the dividends using the gordon model:

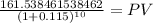

(10 x 1.05) / (0.115 - 0.05) = 161.5384615

ow, as this is 10 years into the future we have to discount this for 10 years:

Maturity $161.5385

time 10.00 years

rate 0.11500 (we use the required rate of return)

PV 54.3910

The stock will be correctly priced at $54.39