Answer:

0.025 is the probability that the fund returns over 50% next year.

Step-by-step explanation:

We are given the following information in the question:

Mean, μ = 26%

Standard Deviation, σ = 12%

Empirical Formula:

- Almost all the data lies within three standard deviation from the mean for a normal data.

- About 68% of data lies within one standard deviation of the mean.

- Around 95% of data lies within two standard deviation of the mean.

- About 99.7% of data lies within three standard deviations of mean.

- The mean divide the data into two equal parts.

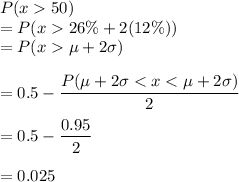

We have to find the approximate probability of the fund returns over 50% next year.

0.025 is the probability that the fund returns over 50% next year.