Answer:

Step-by-step explanation:

The situation described corresponds to a constant annuity for a series of years. This is the value of a series of annual contant payments, at a constant rate.

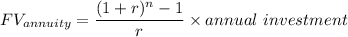

The formula to calculate the future value of constant annuity, starting a year from today, is:

Where:

- r is the constant interest rate: 12.0% = 0.12

- n is the number of years: 18

(the goal)

(the goal)

- Annual investment: is the amount they have to save each year to reach their goal.

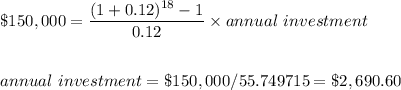

Substitute and solve for tha annual investment: