Answer:

1) Monthly payments:

2) Balance in ten years:

Step-by-step explanation:

1. What are the monthly payments?

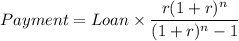

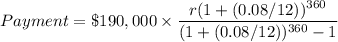

The formula to compute the monthly payment of a loan is:

Where:

- Payment is the monthly payment

- r is the monthly interes rate: 8% / 12 = 0.08/12

- n is the number of months: 12 × 30 = 360

- Loan = $190,000

Substitute and compute:

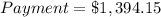

2. What would the loan balance be in ten years?

There is a formula to calculate the balance in any number of years:

![Balance=Loan(1+r)^n-Payment* \bigg[((1+r)^n-1)/(r)\bigg]](https://img.qammunity.org/2021/formulas/business/college/40j1gbvu0xjga4jv4dlmn7cw5bs4jiweei.png)

Substitute with n = 10 × 12 and compute:

![Balance=\$190,000(1+(0.08/12))^((10* 12))-\$1,394.15* \bigg[((1+(0.08/12))^((10* 12))-1)/((0.08/12))\bigg]](https://img.qammunity.org/2021/formulas/business/college/cjv1n8zrohr3uhe3cz8gzoxtrguq8nl3vg.png)