Answer:

$964.42 approx.

Step-by-step explanation:

Current value of a bond is the present value of it's future stream of coupon payments as well as it's redemption value upon maturity.

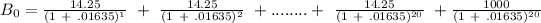

Here, coupon rate = 2.850/2 = 1.425% per period

N = no of periods = 10 years × 2 = 20 periods

Face Value = $1000 assumed

Yield to maturity (YTM) = 3.27/2 = 1.635%

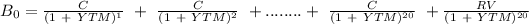

Present Value or

shall be calculated as:

shall be calculated as:

= 16.94 × 14.25 + 722.99 = 241.4280 +722.99

= 16.94 × 14.25 + 722.99 = 241.4280 +722.99

= $ 964.418

= $ 964.418

Thus, current price of the bond is $964.42 approx.