Answer:

Market-to-book ratio=3.44591 times

Step-by-step explanation:

Give data:

Total assets=$1.37 billion

Current liabilities=$186 m

Long term debt=$414 m

Common Equity=$770 m

Number of share of common stock= 57 m

Current stock price=$46.55

Required:

the firm's market-to-book ratio=?

Solution:

We will calculate the book value of each share:

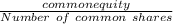

Book value per share=

Book value per share=

Book value per share=$13.50877

Market-to-book ratio=

Market-to-book ratio=

Market-to-book ratio=3.44591 times