Answer:

The arbitrage opportunities are as Buy Eurodollar futures, Borrow Money for 9 months and Invest Money for 6 months.

Step-by-step explanation:

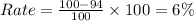

The future rate of Eurodollar at the end of contract expiring in six months is

This is biannual compounding with actual on 360 days.

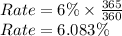

Now converting this into the continuous compounding as

The formula for continuous compounding is as

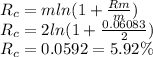

Now from the formula

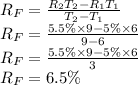

As the forward rate is more than both the 6 month and 9 month rate thus

The arbitrage opportunities are as Buy Eurodollar futures, Borrow Money for 9 months and Invest Money for 6 months.