Answer:

Part (a)

Buying of land would be smart thought if the net present estimation of advantage is at any rate equal to or more prominent than the present estimation of cost of land.

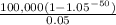

Net present estimation of land =

= $1,825,592.54

The expense of land is anyway $2,000,000. The net present expense of land is more noteworthy than the advantages. Subsequently it isn't a good thought to purchase the land.

Part (b)

The maximum sum that ought to be paid ought to be equivalent to the net present estimation of advantages, for example $1,825,592.54.

Part (c)

If the entertainment benefits increment by 3 years then the net present estimation of advantages for a long time would be:

=

![(100,000 * [ 1 - (1.03/1.05)^(50) ] )/((0.05-0.03))](https://img.qammunity.org/2021/formulas/business/college/xhlxznomvw6y85v9sweppicqta9f64m71t.png)

=$3088535.28

The land should be purchased since the present estimation of advantages is more prominent than cost.