Answer:

So then the best option for the first part would be:

D) 6.14%

So then the correct option for this case would be:

C) 0.498%

Step-by-step explanation:

For this case we have the following info given:

PMT = represent the monthly payments on this case 4000

The upfront cost is 200000

APR= 6% = 0.06 quarterly

n = represent the numbe rof times that the interest is compounded at 1 year.

We assume that for this case we have compounded interest.

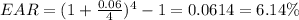

We can calculate the effective annual rate with the following formula:

And if we replace we got:

So then the best option for the first part would be:

D) 6.14%

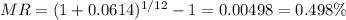

Now for the second part we need to calculate the discount rate that you should use to evaluate the truck lease, so we can use the monthly rate formula given by:

So then the correct option for this case would be:

C) 0.498%