Answer:

price for selling 3000 share right is $25060.87

Step-by-step explanation:

Given data:

Total Amount raised= $4,400,000

Spreading rate = 6%

Subscription price = $20 per share

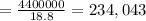

Number of share owned by company = 500,000

Per share cost = $45

Totals share own in the company = 3000

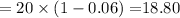

subscription price after deducting spreading rate

Now, Right share

Right price is calculated as

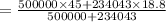

Right price = ((Number of share held * market price) + (Right share *Right price))/( Number of share held + Right share)

plugging all value in above relation

Right share = $36.65

single right value = 45- 36.65 = $8.35

Price for 3000 share right = 8.35 *3000 = $25060.86