Answer:

attached table

Step-by-step explanation:

We use goal seek of excel to determinate the market rate:

Which is the rate that discounting the coupon payment and maturity matches the 5,421,236 we receive for the bond:

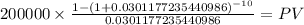

C 200,000.000

time 10

rate 0.030117724

PV $1,705,016.0533

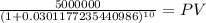

Maturity 5,000,000.00

time 10.00

rate 0.030117724

PV 3,716,219.95

PV c $1,705,016.0533

PV m $3,716,219.9467

Total $5,421,236.0000

Now, we determiante the schedule by doing as follow:

carrying value x market rate = interest expense

cash outlay per period: face value x coupon rate

the amortization will be the difference

after each payment we adjust the carrying value by subtracting the amortization