Answer:

$1.8780/£

Step-by-step explanation:

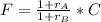

According to the international Fisher effect, the relationship between the interest rate and the exchange rate between two countries A and B, after one year, is:

Where F is the future exchange rate, r is the interest rate, and C is the current exchange rate.

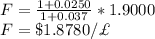

If the US has an interest rate of 2.50%, the UK has a rate pf 3.70% and the current exchange rate is $1.9000/£, the spot rate in one year will be:

In one year, the spot rate will be $1.8780/£.