Answer:

PMT = $3875.00

Step-by-step explanation:

given data

annuity selling = $14,427.59

time = 4 year

interest rate = 5 %

solution

we get here annual annuity payment that is express as

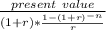

PMT =

..................................1

..................................1

put here valuer and we get

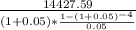

PMT =

solve it now and we get

PMT = $3875.00

so here value of the annual annuity payment (PMT) is $3875.00