Answer:

The withdrawals will be of $ 11,379.014 per month

Step-by-step explanation:

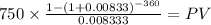

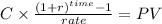

Future value of the annuities:

C 750.00

time 360(30 years x 12 monhs per year)

rate 0.008333333 (10% / 12 months)

PV $1,695,365.9436

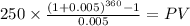

C 250.00

time 360 (30 years x 12 monhs per year)

rate 0.005 (6% / 12 months)

PV $251,128.7606

Total 1,695,365.84 + 251,128.76 = 1.946.494,6

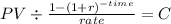

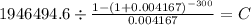

and from here we withdraw for 25 years:

PV 1,946,495

time 300 (25 years x 12 months)

rate 0.004166667 (5% / 12 months)

C $ 11,379.014