Answer:

current price = $1191.79

Step-by-step explanation:

given data

time t = 15 year

annual coupon bonds rate = = 7.5 %

par value = $1000

interest rate = 5.5%

maturity time = 14 year

to find out

current price of the bonds

solution

we get here first annual coupon rate = 7.5% of 1000

annual coupon rate C = $75

so now we get current price of bond

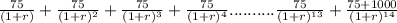

current price of the bonds =

.................1

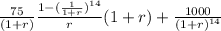

.................1

put here value

current price =

current price =

solve it we get

current price = $1191.79