Answer:

Depreciation under 3 methods:

A. SLM: Depreciation $5,600,000

B. Units Of Production: Depreciation $9,212,500

C. Double Declining Method: Depreciation $13,400,000

Step-by-step explanation:

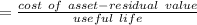

A. Under Straight line method, depreciation as computed as:

Depreciation = $5,600,000

Book Value at the end of first year = $27,900,000

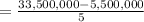

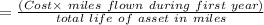

B. Units Of Production Method:

Depreciation:

= 9,212,500

Book Value at the end of first year = 24,287,500

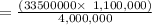

C. Double Declining Method: Depreciation=

= 20% per annum

Under double decline , at double the rate i.e 40%

Thus, Depreciation = 40% of 33,500,000= 13,400,000

Book Value at the end of the year = 33,500,000- 13,400,000 = 20,100,000